Financial Planning

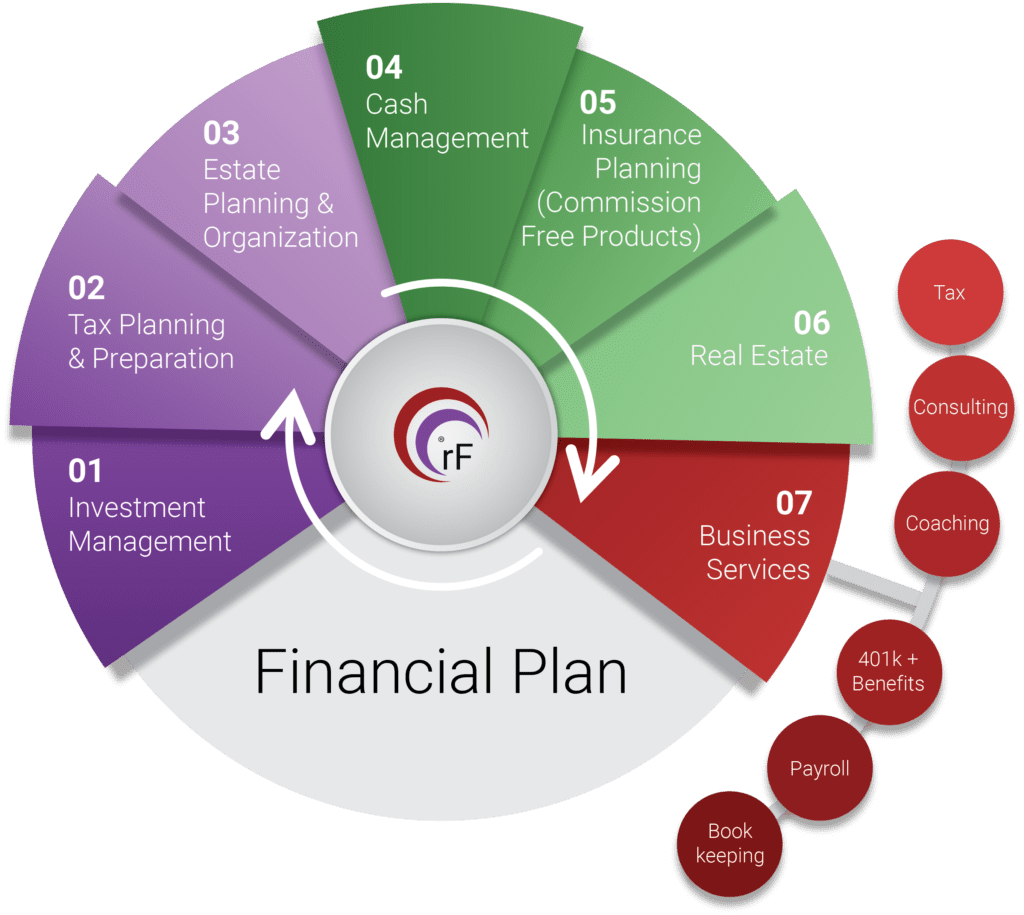

In the realm of financial planning, our approach stands out as a beacon of comprehensive excellence. With a plethora of cutting-edge financial tools at our disposal, we are poised to provide advice that transcends the ordinary. What truly sets us apart is the synergy of expertise from our team of certified financial planning practitioners, each specializing in areas of the financial landscape. This diverse cadre of professionals allows us to offer a well-rounded and holistic perspective, ensuring that every aspect of your financial journey is meticulously considered. The real magic lies in our ability to seamlessly integrate these various niches, fostering a collaborative environment where unique specialties converge to create actionable solutions. At our core, we are not just advisors; we are orchestrators of financial success, bringing together the best minds to navigate the complexities of your financial goals and turn them into tangible realities.

Who We Are & What We Do For You

Personal CFO

We are your personal chief financial officer. We help you with you tax flow, taxes, etc. pulling everything together for you.

Fiduciary Advocate

We're going to fight for you to get a better deal so you don't miss our on any opportunities.

Financial Planning

Our advisors are primarily CFP advisors. We're your fiduciary advocate. We work for you and not any of these other financial companies and thats why we have multiple custodians to use at your disposal.

Intense Implementor

We try to take over as much as we can and do it for you so that it wil actually get done instead of creating a plan and not implementing it for you.

MISSION-DRIVEN

Tailoring Financial Success: Our Holistic Approach to Your Financial Planning Journey

We understand that every financial journey is unique, and that’s why we offer a holistic approach to financial planning. Our mission is to help you achieve your dreams while ensuring your financial security.

1. Discover

2. Goals

3. Opportunities

1. Discover

2. Goals

3. Opportunities

4. Implementation

5. Documentation

6. Update

7. Monitor

4. Implementation

5. Documentation

6. Update

7. Monitor

4. Implementation

5. Documentation

6. Update

7. Monitor

Financial planning is about more than solving immediate financial challenges. While we can certainly help you with those, our focus is on something greater.

Investment Management

Our investment management services are designed to work in harmony with your financial plan. A well-executed investment strategy can significantly contribute to achieving your broader financial goals. We understand that no two individuals are the same, and neither should their investment strategies be.

Learn About Our Tax Services

Tax Preparation

Streamline tax prep with our efficient services. We ensure accuracy, maximize deductions, and navigate complex regulations for a stress-free tax season. Trust us to optimize your financial filings with expertise and ease.

Tax Optimization

Plan ahead with proactive tax modeling, preventing future surprises. Consider the next 10-20 years, as saving on taxes today may lead to challenges. Embrace proactive tax planning, using tools like Monte Carlo simulations to depict potential outcomes and enhance financial success.

Tax Planning

Optimize your financial future with strategic tax planning. We analyze your situation, identify opportunities, and create a personalized strategy to minimize liabilities. Ensure long-term success by proactively managing your tax implications.

Tax Monitoring

Stay ahead with our vigilant tax monitoring using tools like Tax Status, HolistaPlan, and FP Alpha. We track changes, assess impacts, and provide real-time insights to optimize your financial strategy. Trust us to ensure ongoing compliance and adapt your plan for maximum efficiency.

Estate Services

In cooperation with our Legal/Attorney Partners, our mission is to help you leave a lasting legacy, not a legal battle. By considering various scenarios, we ensure that your loved ones receive your assets as intended, minimizing any interference from lawyers or government entities. Our goal is to protect and preserve your wealth, ensuring it benefits the people you cherish most while simplifying the estate process.

Estate Planning

You have flexible options when working with us. You can opt to partner with your personal attorney, leverage our recommended professionals, or explore the convenience of our user-friendly online estate planning document tools. We provide a spectrum of choices to cater to your preferences and ensure a seamless and tailored approach to estate planning.

Modeling & Optimization

Our mission is to help you leave a lasting legacy, not a legal battle. By considering various scenarios, we ensure that your loved ones receive your assets as intended, minimizing any interference from lawyers or government entities. Our goal is to protect and preserve your wealth, ensuring it benefits the people you cherish most while simplifying the estate process.

Enhancing Your Financial Planning Strategy with Cutting-Edge Tools

We aim to go above and beyond to provide you with some of the most advanced financial planning solutions. We understand that each financial journey is unique, which is why we offer specialized niche software to help you optimize your financial strategy. These tools are designed to complement our comprehensive financial planning services, ensuring you have a well-rounded strategy that meets your unique needs.

Holistiplan

Revolutionize your financial strategies with Holistiplan

Discover the power of tax optimization as you delve into comprehensive analyses of your unique tax situations, unlocking opportunities for savings and financial efficiency.

Holistiplan empowers you to visualize potential tax outcomes through scenario modeling, providing clarity for pivotal decisions such as Roth conversions or venturing into new business endeavors. With user-friendly visual tools, complex tax data becomes easily understandable, promoting open communication and enriching your grasp of financial implications.

Elevate your financial planning experience beyond taxes – Holistiplan supports holistic planning, incorporating income strategies, Social Security planning, and other vital components crucial for your financial well-being. Step into a new era of financial empowerment with Holistiplan at the forefront of your financial toolkit.

Empower your financial journey through Holistiplan.

- For Roth conversions, Holistiplan models tax implications, guiding educated timing and amounts for maximum benefits.

- Nearing retirement? Holistiplan crafts income plans, addressing possibilities in shortfalls and ensuring security.

- Want tax-efficient investments? Holistiplan assists with portfolios balancing returns and efficiency.

- Concerned about estate taxes? Holistiplan fine-tunes legacies, minimizing heirs’ burdens.

Integrating Holistiplan enables rebel Financial to deliver personalized, tax-optimized plans tailored to each client’s unique goals.

Everplans

Empower Your Financial Journey with Everplans

Everplans is more than a tool – it’s your partner in navigating life’s financial intricacies. Imagine effortlessly organizing crucial documents and ensuring your wishes are met in estate planning. With Everplans, your digital vault keeps everything secure and accessible. Picture a personalized end-of-life plan tailored to your financial and personal preferences. It’s not just guidance; it’s peace of mind. Join us in unlocking the full potential of your financial future with Everplans by your side.

- Feel overwhelmed about estate planning? Everplans can simplify the process, assisting you in organizing vital documents and expressing your wishes clearly.

- Worried about document security and accessibility? Everplans provides a secure digital vault, granting you peace of mind as your important papers are safeguarded and easily accessible whenever needed.

- Considering end-of-life planning but unsure where to begin? Everplans acts as your guide, helping you craft a personalized plan covering financial affairs and personal wishes that perfectly align with your unique preferences and priorities.

Join us in leveraging Everplans for a more organized, secure, and personally meaningful financial future.

FP Alpha

Integrated into our services, FP Alpha unlocks tailored solutions for your unique needs. Whether tackling taxes, planning retirement, or optimizing investments, FP Alpha empowers us.

With FP Alpha, your financial goals become tangible realities.

- Uncertain about the tax implications of potential investments? FP Alpha can simplify the process, visualizing the tax landscape and offering insights into potential benefits. Gain a clear understanding of the optimal tax strategy, ensuring well-informed investment decisions and increasing odds of maximizing benefits.

- Nearing retirement and unsure about income sources? Utilize FP Alpha to analyze various income streams, crafting a personalized retirement plan. The outcome? A comprehensive strategy optimizing income, addressing potential shortfalls, and ensuring a secure retirement.

- Want to invest while minimizing tax implications? FP Alpha assesses scenarios, balancing returns and tax efficiency to design an investment portfolio aligned with your financial goals.

- Unsure how major financial decisions might impact your future? FP Alpha creates scenarios, providing confidence in decision-making with a clear understanding of potential outcomes.

Join us as we leverage FP Alpha to turn your financial aspirations into realistic achievements.

Try our free questionnaire below to receive a report with your Financial Wellness Score and potential recommendations.

SS Analyzer

With SS Analyzer. we empower you with insights and clarity to navigate the complexities of Social Security. Picture scenarios like being widowed or having special needs dependents, where SS Analyzer unveils hidden opportunities for additional benefits. Whether you’re concerned about potential Medicare payments or optimizing your Social Security strategy, SS Analyzer provides a roadmap for financial security.

- Recently widowed and uncertain about Social Security, SS Analyzer explores claiming strategies to create a maximized widowhood benefit plan, offering crucial financial support.

- For clients with special needs dependents considering Social Security, SS Analyzer identifies unique claiming options, crafting a tailored strategy that addresses specific financial needs.

- Concerned about Medicare payments impacting Social Security, SS Analyzer minimizes Medicare-related impacts, developing a strategic plan that optimizes Social Security while mitigating Medicare costs.

- When uncertain about the long-term impact of Social Security decisions, SS Analyzer projects future scenarios, instilling confidence in choosing a claiming strategy aligned with long-term financial goals.

SS Analyzer isn’t just a calculator; it’s your partner for maximizing benefits and securing your financial future. Join us in leveraging SS Analyzer for a more informed and personalized Social Security journey.

Income Planning

Navigating your financial future involves more than just Social Security or pension considerations. As we delve into comprehensive planning, it’s crucial to address income sources beyond the conventional options. Some individuals may lack substantial pensions or opt to leave funds in accounts, posing the question: What’s the optimal strategy? With rising interest rates, considerations shift towards exploring annuities or insurance products. However, it’s essential to tread carefully, as these options can be costly and often misrepresented by commission-driven sales.

At rebel Financial, we’ve forged partnerships with DPL financial partners, unlocking access to Commission-free or Super Low Commission tools. Here are a couple of scenarios where we can assist and navigate through income planning:

- Diverse Income Strategies: Explore a range of income sources beyond traditional pensions, finding tailored solutions for your unique situation.

- Annuity Evaluation: Assess the viability of annuities or insurance products, considering cost-effectiveness and alignment with your financial goals.

- Income Planning Tools: Leverage advanced tools to model and optimize future income scenarios, ensuring a clear understanding of potential outcomes.

- Commission-Free Solutions: Benefit from our partnerships to access Commission-free or Super Low Commission options, providing cost-effective avenues for income planning.

- Risk Mitigation Strategies: Implement strategies to mitigate risks associated with income planning, ensuring a stable and secure financial future.

Let’s chart a course for your financial success, navigating the intricacies of income planning with expertise and personalized strategies.

Enhancing Your Financial Planning Strategy with Cutting-Edge Tools

We aim to go above and beyond to provide you with some of the most advanced financial planning solutions. We understand that each financial journey is unique, which is why we offer specialized niche software to help you optimize your financial strategy. These tools are designed to complement our comprehensive financial planning services, ensuring you have a well-rounded strategy that meets your unique needs.

Holistiplan

Discover the power of tax optimization as you delve into comprehensive analyses of your unique tax situations, unlocking opportunities for savings and financial efficiency.

Holistiplan empowers you to visualize potential tax outcomes through scenario modeling, providing clarity for pivotal decisions such as Roth conversions or venturing into new business endeavors. With user-friendly visual tools, complex tax data becomes easily understandable, promoting open communication and enriching your grasp of financial implications.

Elevate your financial planning experience beyond taxes – Holistiplan supports holistic planning, incorporating income strategies, Social Security planning, and other vital components crucial for your financial well-being. Step into a new era of financial empowerment with Holistiplan at the forefront of your financial toolkit.

Empower your financial journey through Holistiplan.

- For Roth conversions, Holistiplan models tax implications, guiding educated timing and amounts for maximum benefits.

- Nearing retirement? Holistiplan crafts income plans, addressing possibilities in shortfalls and ensuring security.

- Want tax-efficient investments? Holistiplan assists with portfolios balancing returns and efficiency.

- Concerned about estate taxes? Holistiplan fine-tunes legacies, minimizing heirs’ burdens.

Integrating Holistiplan enables rebel Financial to deliver personalized, tax-optimized plans tailored to each client’s unique goals.

Everplans

Everplans is more than a tool – it’s your partner in navigating life’s financial intricacies. Imagine effortlessly organizing crucial documents and ensuring your wishes are met in estate planning. With Everplans, your digital vault keeps everything secure and accessible. Picture a personalized end-of-life plan tailored to your financial and personal preferences. It’s not just guidance; it’s peace of mind. Join us in unlocking the full potential of your financial future with Everplans by your side.

- Feel overwhelmed about estate planning? Everplans can simplify the process, assisting you in organizing vital documents and expressing your wishes clearly.

- Worried about document security and accessibility? Everplans provides a secure digital vault, granting you peace of mind as your important papers are safeguarded and easily accessible whenever needed.

- Considering end-of-life planning but unsure where to begin? Everplans acts as your guide, helping you craft a personalized plan covering financial affairs and personal wishes that perfectly align with your unique preferences and priorities.

Join us in leveraging Everplans for a more organized, secure, and personally meaningful financial future.

FP Alpha

Integrated into our services, FP Alpha unlocks tailored solutions for your unique needs. Whether tackling taxes, planning retirement, or optimizing investments, FP Alpha empowers us.

With FP Alpha, your financial goals become tangible realities.

- Uncertain about the tax implications of potential investments? FP Alpha can simplify the process, visualizing the tax landscape and offering insights into potential benefits. Gain a clear understanding of the optimal tax strategy, ensuring well-informed investment decisions and increasing odds of maximizing benefits.

- Nearing retirement and unsure about income sources? Utilize FP Alpha to analyze various income streams, crafting a personalized retirement plan. The outcome? A comprehensive strategy optimizing income, addressing potential shortfalls, and ensuring a secure retirement.

- Want to invest while minimizing tax implications? FP Alpha assesses scenarios, balancing returns and tax efficiency to design an investment portfolio aligned with your financial goals.

- Unsure how major financial decisions might impact your future? FP Alpha creates scenarios, providing confidence in decision-making with a clear understanding of potential outcomes.

Join us as we leverage FP Alpha to turn your financial aspirations into realistic achievements.

Try our free questionnaire below to receive a report with your Financial Wellness Score and potential recommendations.

SS Analyzer

With SS Analyzer. we empower you with insights and clarity to navigate the complexities of Social Security. Picture scenarios like being widowed or having special needs dependents, where SS Analyzer unveils hidden opportunities for additional benefits. Whether you’re concerned about potential Medicare payments or optimizing your Social Security strategy, SS Analyzer provides a roadmap for financial security.

- Recently widowed and uncertain about Social Security, SS Analyzer explores claiming strategies to create a maximized widowhood benefit plan, offering crucial financial support.

- For clients with special needs dependents considering Social Security, SS Analyzer identifies unique claiming options, crafting a tailored strategy that addresses specific financial needs.

- Concerned about Medicare payments impacting Social Security, SS Analyzer minimizes Medicare-related impacts, developing a strategic plan that optimizes Social Security while mitigating Medicare costs.

- When uncertain about the long-term impact of Social Security decisions, SS Analyzer projects future scenarios, instilling confidence in choosing a claiming strategy aligned with long-term financial goals.

SS Analyzer isn’t just a calculator; it’s your partner for maximizing benefits and securing your financial future. Join us in leveraging SS Analyzer for a more informed and personalized Social Security journey.

Income Planning

Navigating your financial future involves more than just Social Security or pension considerations. As we delve into comprehensive planning, it’s crucial to address income sources beyond the conventional options. Some individuals may lack substantial pensions or opt to leave funds in accounts, posing the question: What’s the optimal strategy? With rising interest rates, considerations shift towards exploring annuities or insurance products. However, it’s essential to tread carefully, as these options can be costly and often misrepresented by commission-driven sales.

At rebel Financial, we’ve forged partnerships with DPL financial partners, unlocking access to Commission-free or Super Low Commission tools. Here are a couple of scenarios where we can assist and navigate through income planning:

- Diverse Income Strategies: Explore a range of income sources beyond traditional pensions, finding tailored solutions for your unique situation.

- Annuity Evaluation: Assess the viability of annuities or insurance products, considering cost-effectiveness and alignment with your financial goals.

- Income Planning Tools: Leverage advanced tools to model and optimize future income scenarios, ensuring a clear understanding of potential outcomes.

- Commission-Free Solutions: Benefit from our partnerships to access Commission-free or Super Low Commission options, providing cost-effective avenues for income planning.

- Risk Mitigation Strategies: Implement strategies to mitigate risks associated with income planning, ensuring a stable and secure financial future.

Let’s chart a course for your financial success, navigating the intricacies of income planning with expertise and personalized strategies.

Start Your Financial Planning Journey with rebel Financial

Ready to embark on your financial journey? We invite you to schedule a free consultation with our experts. Just like the individuals in the scenarios above, you can benefit from our holistic approach to financial planning.