“Should I roll over my 529 account to an ABLE account?”: A Financial Decision for Families with Children with Disabilities

For families with children with disabilities, financial planning often involves navigating unique challenges and considerations. Recently, I had a conversation with a client facing a common dilemma: what to do with a substantial 529 account originally created for their child, who has a disability. This scenario prompted me to delve more deeply into the options available and to consider the implications of each choice.

Special Needs Planning

Raising a child with a disability can be both richly rewarding and all-consuming away.

VIEW SPECIAL NEEDS INFO

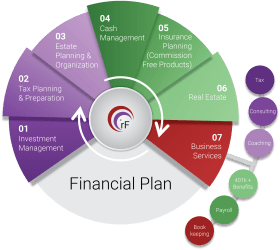

529 accounts, designed primarily for education expenses, offer tax advantages and investment growth opportunities. However, when the intended beneficiary won’t utilize the funds for education, alternatives need to be considered. The client pondered whether to roll over the 529 into a Roth account or an ABLE (Achieving a Better Life Experience) account.

The distinction between 529 and ABLE accounts lies in their permissible uses. While 529s are restricted to educational expenses, ABLE accounts are more flexible, catering to a broader range of disability-related costs. This flexibility is crucial for families with children whose needs extend beyond educational pursuits.

In our discussion, I emphasized the advantages of transitioning the funds into an ABLE account. Beyond educational expenses, ABLE funds can cover various essential costs benefiting the child with a disability, such as housing, transportation, healthcare, and assistive technology. This expanded utility provides families with much-needed financial flexibility, aligning more closely with the child’s long-term needs.

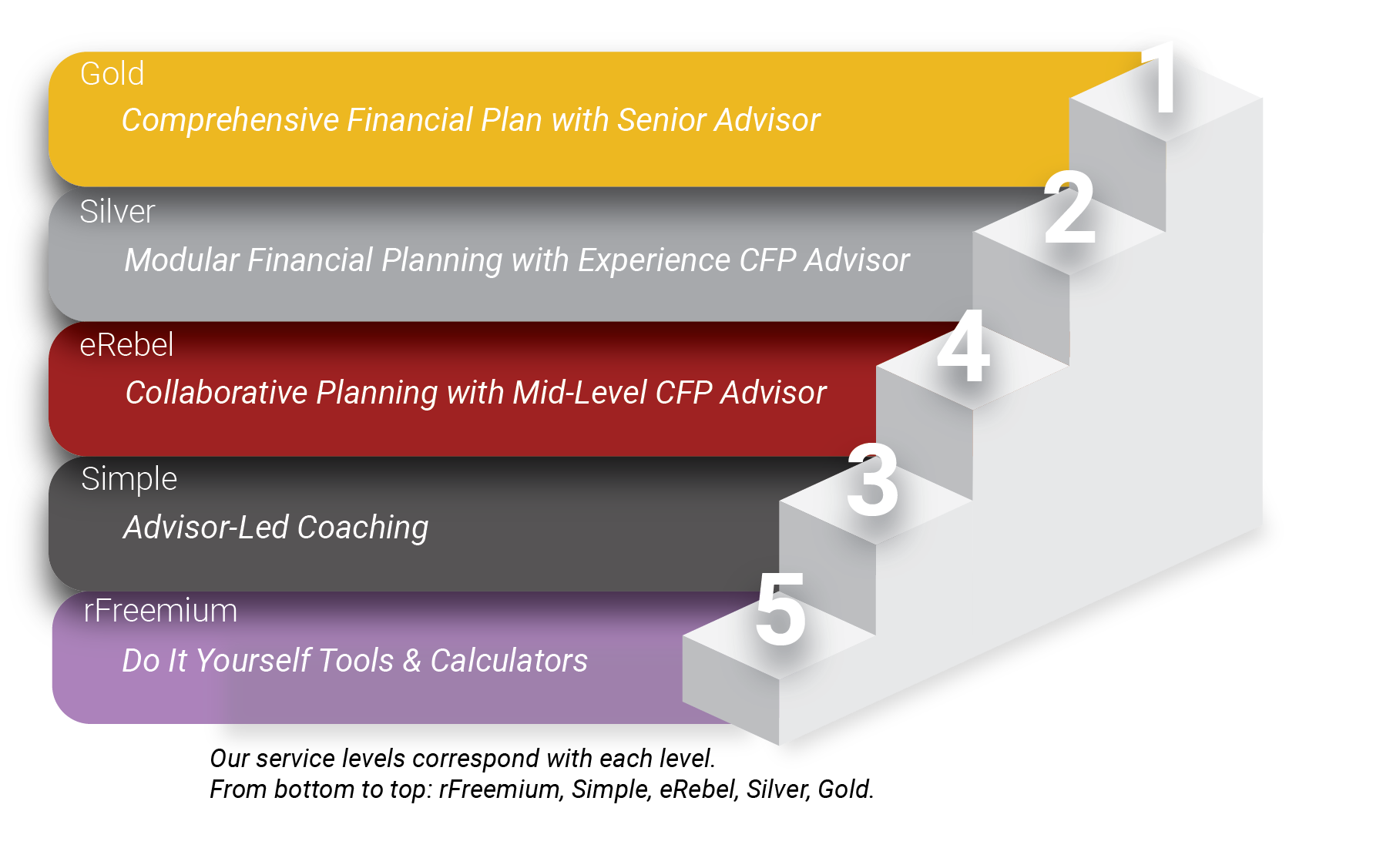

We Don’t Turn People Away

While we may not be the perfect “fit” for everyone’s needs, we have a huge disdain for the common industry practice of turning people away.

VIEW PLANS

While the investment options in a 529 account may seem appealing, ABLE accounts still offer a range of quality investment choices. Additionally, contribution limits in ABLE accounts must be considered. Families cannot transfer the entirety of a large 529 balance in one go, as contribution limits apply. However, this limitation can be managed over time, ensuring a gradual transition of funds without exceeding the yearly contribution cap

It’s crucial to address the 529 account responsibly. Simply withdrawing funds without utilizing them for qualified expenses incurs tax penalties. Rolling over into an ABLE account presents the cleanest solution, preserving the funds’ tax-advantaged status and directing them towards the child’s well-being.

In summary, when faced with a sizable 529 account designated for a child with a disability, transitioning to an ABLE account seems to be the most advantageous option for families. The enhanced flexibility and alignment with the child’s needs make it a compelling choice. While individual circumstances may vary, careful consideration and consultation with financial advisors can guide families towards making informed decisions that best serve their child’s financial future and overall well-being.

Did you find this article helpful? Share it!

ABOUT AUTHOR

Phil Ratcliff

Schedule a meeting

Disclaimer: The information contained on this blog is for informational and educational purposes only and should not be construed as professional financial advice. Investment decisions should be based on your individual circumstances and objectives. Before making any investment decisions, you should consult with a qualified financial advisor, tax advisor, and/or attorney to determine what may be best for your individual situation.