With hurricanes Helene and Milton affecting many in the Southeast, it’s essential to check in on those around us. Natural disasters don’t just leave physical damage; they can also impact the economy in profound ways.

How Hurricanes Affect the Economy

Natural disasters like hurricanes can disrupt economies by impacting supply chains, slowing economic growth, and creating market volatility. Here are some specific ways hurricanes affect financial systems:

1. Supply Chain Disruptions

Closed roads and damaged ports can hinder the movement of goods, affecting local and national supply chains. This can lead to shortages, delays, and increased costs.

2. Economic Slowdown

When businesses shut down and jobs are lost, consumer demand naturally decreases. This slowdown can hinder economic growth, especially in heavily affected regions.

3. Market Volatility

In the immediate aftermath of a storm, markets may experience short-term volatility as investors react to news and shift their portfolios. While these fluctuations are often temporary, they can be significant.

4. Energy Price Spikes

Hurricanes often disrupt energy supplies, leading to price increases. This ripple effect can raise costs for businesses and consumers alike.

The Mixed Economic Impact Hurricanes Have On Businesses

Some companies may face financial challenges due to anticipated disaster losses, while others may benefit from increased demand for their products or services. For example, insurers typically experience losses, whereas businesses that offer emergency equipment may see a sales boost. [1]

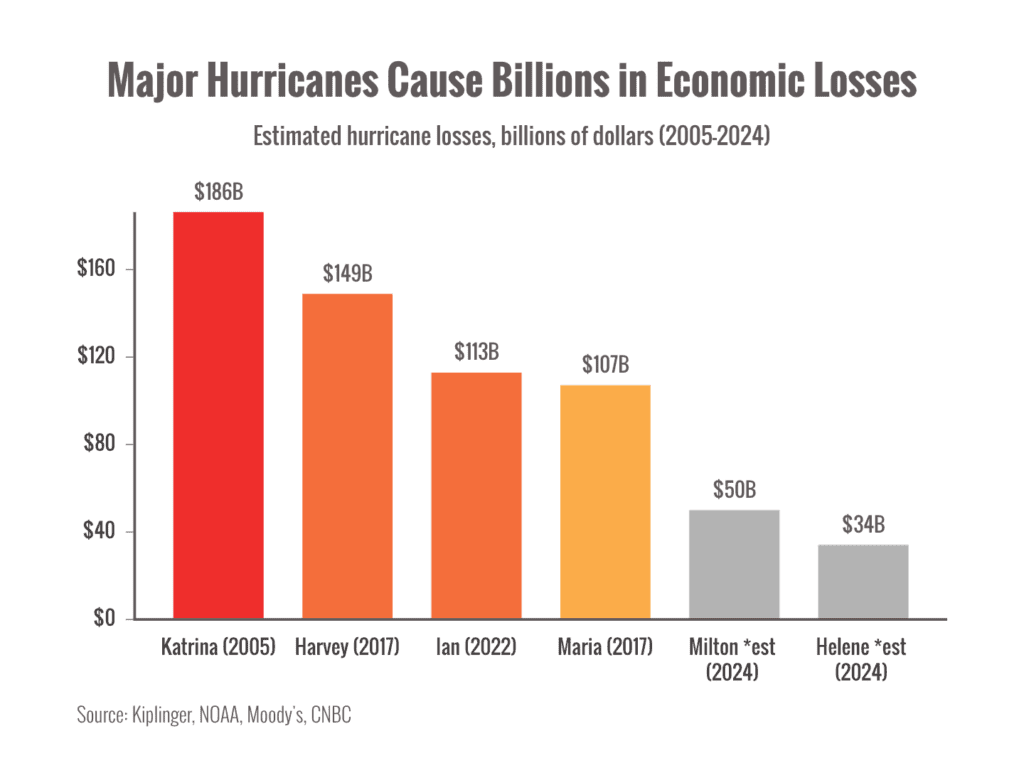

This chart shows the financial cost of some hurricanes in the last two decades.

Long-Term Hurricane Economic Effects

While natural disasters can have severe short-term impacts, research indicates that their long-term effects on the broader economy are generally limited. [2] It’s essential to remember that while billions of dollars in losses are significant, they represent only a small fraction of the overall U.S. economy, which is valued at over $27 trillion. [3]

This chart shows the financial cost of some hurricanes in the last two decades.

Looking Ahead

In the wake of these hurricanes, we might see changes in inflation, employment rates, and overall growth data. Alongside these domestic impacts, markets are also contending with international tensions and upcoming political events. We’re monitoring these developments and will provide specific recommendations as needed.

Stay Connected

If you have any questions or concerns, feel free to reach out. In times like these, it’s vital to stay informed and connected. Please take care and appreciate the loved ones around you.

Did you find this article helpful? Share it!

ABOUT AUTHOR

Dylan Elmore

Sources:

- https://www.cnbc.com/2024/10/07/generator-maker-generac-soars-insurance-stocks-fall-on-hurricane-milton.html

- https://www.frbsf.org/wp-content/uploads/wp2020-34.pdf

- https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?end=2023&locations=US&start=1960&view=chart

Chart sources: https://www.investors.com/news/hurricane-helene-34-billion-price-tag-stock-market-impact/

The information provided on this blog is for general informational purposes only and does not constitute financial, investment, legal, or tax advice.The content represents the opinions of the author and should not be interpreted as personalized financial advice.

You should not rely solely on the information provided herein and should seek the advice of a qualified financial advisor, registered investment advisor, tax professional, or legal counsel before making any financial decisions. The strategies and investments discussed may not be suitable for all investors, as individual financial situations vary.

rebel Financial, LLC, is a registered investment adviser. To see a more detailed description of the company, its management, and practices, view our (Form ADV, Part2A) and Disclosures.